Trump No Taxes On Tips: Understanding The Controversy

The topic of taxes has always been a hot-button issue in American politics, and when it comes to Donald Trump, the discussion becomes even more charged. The phrase "Trump no taxes on tips" has circulated widely, sparking debate about tax liabilities and the ethics of wealth. In this article, we will delve into the specifics of this controversy, exploring the implications of tax codes on gratuities, and examining Trump's financial strategies. Through this analysis, we'll aim to provide clarity and insight into a complex topic that affects many Americans.

The issue of taxation on tips is particularly relevant in the service industry, where gratuities often make up a significant portion of a worker's income. This article will not only focus on Trump’s situation but will also highlight how tax regulations apply to tips across the board. By understanding the broader context, readers can better grasp the nuances of this issue. Whether you are a service worker, a business owner, or simply a concerned citizen, this information is crucial for navigating the tax landscape.

As we unravel the details surrounding "Trump no taxes on tips," we will also touch upon the public's perception of tax fairness and the implications for future tax reforms. Taxation is not just about compliance; it reflects societal values and priorities. Join us as we explore this multifaceted topic and its significance in today's economic climate.

Table of Contents

- Biography of Donald Trump

- Personal Data and Biodata

- Overview of Tips Taxation

- Trump's Tax Practices

- Public Reaction to Trump's Tax Strategies

- Implications for Tax Reform

- Case Studies on Tips and Taxes

- Conclusion

Biography of Donald Trump

Donald John Trump was born on June 14, 1946, in Queens, New York City. He is a businessman, television personality, and politician who served as the 45th President of the United States from January 20, 2017, to January 20, 2021. Trump's business ventures include real estate, hotels, casinos, and golf courses, and he gained fame as the host of the reality television show "The Apprentice."

Early Life and Education

Trump attended Fordham University for two years before transferring to the Wharton School of the University of Pennsylvania, where he graduated with a degree in economics in 1968. He took charge of his family's real estate business in 1971 and began to expand it significantly.

Political Career

Trump announced his candidacy for the presidency in 2015 and ran as a Republican, ultimately winning the election in 2016. His presidency was marked by significant controversies, including debates over tax policies and financial disclosures.

Personal Data and Biodata

| Data | Details |

|---|---|

| Name | Donald John Trump |

| Born | June 14, 1946 |

| Nationality | American |

| Education | Wharton School, University of Pennsylvania |

| Occupation | Businessman, Politician, Television Personality |

| Presidency | 45th President of the United States |

Overview of Tips Taxation

In the United States, tips are considered income and are subject to federal income tax. The Internal Revenue Service (IRS) requires workers to report tips received, and employers are mandated to withhold taxes on those earnings. However, the way tips are taxed can vary, leading to confusion and disparities in how different people are affected.

Tax Responsibilities of Service Workers

Service workers, such as waitstaff, bartenders, and taxi drivers, often rely heavily on tips to supplement their income. Here are some key points regarding their tax responsibilities:

- Tips are taxable income and must be reported to the IRS.

- Employers must ensure that their staff understands how to report tips accurately.

- Failure to report tips can lead to penalties and back taxes owed.

Implications of Non-Reporting Tips

Not reporting tips can have significant implications for workers. Beyond potential legal consequences, failing to report income can affect Social Security benefits and other government assistance programs.

Trump's Tax Practices

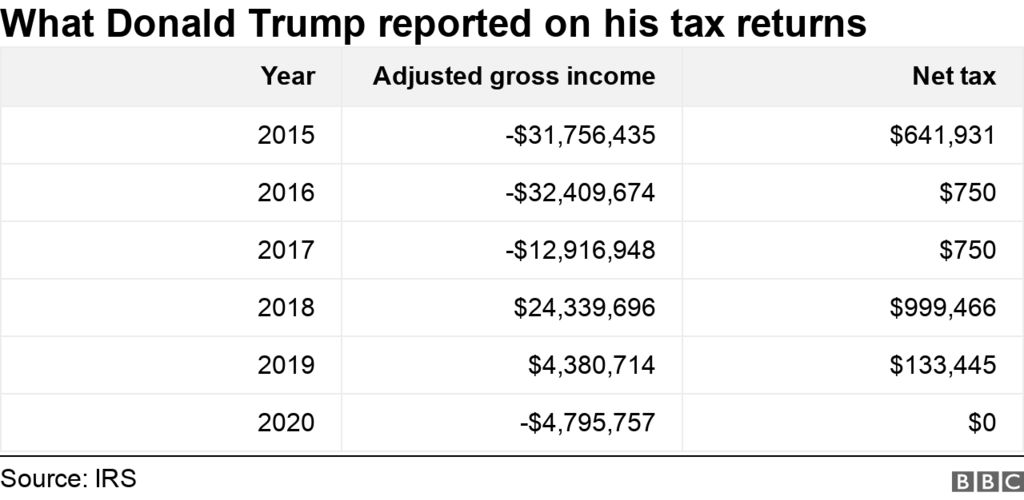

The discussion surrounding "Trump no taxes on tips" often stems from broader criticisms of his tax strategies. In his tax returns, Trump has been reported to have paid little to no federal income tax in certain years, raising questions about the fairness of the tax system.

Tax Strategies Used by High-Income Earners

High-income earners like Trump often utilize various strategies to minimize their tax liabilities:

- Taking advantage of deductions and credits.

- Investing in tax-advantaged accounts.

- Utilizing business expenses to offset income.

Public Controversy Over Tax Payments

The revelation that Trump paid only $750 in federal income taxes in 2016 and 2017 led to widespread outrage. Many argued that such minimal payments highlight systemic issues within the tax code that favor the wealthy.

Public Reaction to Trump's Tax Strategies

The public's reaction to Trump's tax strategies has been polarized, with supporters arguing that he is a savvy businessman taking advantage of the system, while critics decry the lack of tax contributions from billionaires.

Calls for Tax Reform

The controversy surrounding Trump's tax practices has reignited discussions about tax reform in the United States. Many advocate for a more progressive tax system that ensures all individuals contribute fairly based on their income levels.

Impact on Voter Sentiment

Public perception of Trump's tax payments has significantly influenced voter sentiment, particularly among working-class citizens who feel the burden of taxation more acutely. This issue continues to be a focal point in political debates.

Implications for Tax Reform

The ongoing discourse about tax fairness and the treatment of tips in the tax code raises important questions about future reforms. If changes are not made, the disparities in tax contributions will likely persist.

Potential Changes to Tax Legislation

Some proposed reforms include:

- Eliminating loopholes that allow high earners to reduce their tax liabilities.

- Increasing transparency in how tips are reported and taxed.

- Enhancing enforcement of existing tax laws to ensure compliance.

Encouraging Fair Tax Practices

Encouraging fair tax practices among all citizens is crucial for a healthy economy. Ensuring that everyone pays their fair share fosters trust in the system and can lead to better public services and infrastructure.

Case Studies on Tips and Taxes

To better understand the implications of tax policies on tips, several case studies can be examined. These examples highlight how different individuals and businesses navigate the complexities of tax reporting and compliance.

Case Study 1: Restaurant Workers

In a bustling restaurant, servers often depend on tips to make a living. Understanding their tax obligations is essential for financial stability. This case study explores how restaurant workers manage their income and report tips accurately to avoid penalties.

Case Study 2: Ride-Sharing Drivers

Ride-sharing drivers face unique tax challenges as they receive tips directly from customers. This case study examines how these drivers report their earnings and the implications of tip income on their overall tax situation.

Conclusion

In conclusion, the topic of "Trump no taxes on tips" serves as a lens through which we can examine broader issues of tax fairness and compliance in America. As the debate continues, it is essential for individuals to understand their tax obligations, particularly in industries where tips constitute a significant portion of income. Advocating for fair tax practices and reforms can ensure that the tax system works for everyone.

We invite you to share your thoughts on this topic in the comments below. Your perspective is valuable, and engaging in discussions about tax fairness is crucial for fostering a better understanding of these issues. Additionally, feel free to explore other articles on our site that delve into related topics.

Thank you for reading, and we hope to see you back here for more insightful discussions!

Baek Sung Chul: The Rising Star In The Entertainment Industry

Shades Of Green Resort: A Tranquil Escape In Nature

Exploring The Walker Art Center In Minneapolis: A Comprehensive Guide